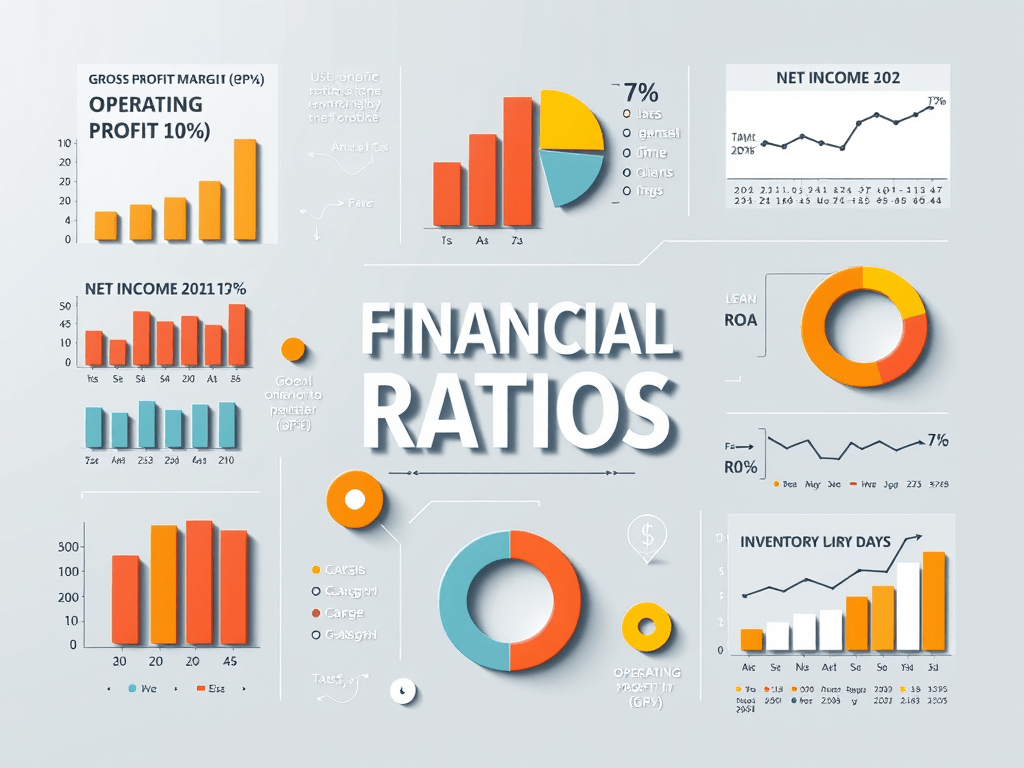

Profitability Ratios

1. Gross Profit Margin Percentage (GP%)

Measures the percentage of revenue remaining after deducting the cost of goods sold (COGS).

Formula:

GP% = (Revenue – Cost of Goods Sold) / Revenue x 100

2. Operating Profit Margin Percentage (Operating Profit %)

Measures the percentage of revenue remaining after deducting both COGS and operating expenses.

Formula:

Operating Profit % = (Revenue – Cost of Goods Sold – Operating Expenses) / Revenue x 100

3. Net Profit Margin Percentage (Net Income %)

Measures the percentage of revenue remaining after deducting all expenses, including interest and taxes.

Formula:

Net Income % = (Revenue – All Expenses) / Revenue x 100

4. Return on Assets (ROA)

Measures profitability in relation to total assets.

Formula:

ROA = Net Income / Total Assets

5. Return on Equity (ROE)

Measures profitability in relation to shareholder equity.

Formula:

ROE = Net Income / Shareholder Equity

Efficiency Ratios

6. Inventory Days

Measures the average number of days it takes a company to sell its inventory.

Formula:

Inventory Days = (Average Inventory / Cost of Goods Sold per day)

7. Receivable Days

Measures the average number of days it takes a company to collect payments from customers.

Formula:

Receivable Days = (Average Accounts Receivable / Revenue per day)

8. Payable Days

Measures the average number of days it takes a company to pay its suppliers.

Formula:

Payable Days = (Average Accounts Payable / Cost of Goods Sold per day)

Note: Only accounts payable is considered, not total liabilities.

Financial Leverage Ratios

9. Debt to Equity Ratio

Measures the amount of debt in relation to shareholder equity.

Formula:

Debt to Equity Ratio = Total Liabilities / Shareholder Equity

10. Interest Coverage Ratio

Measures a company’s ability to meet its interest payments on debt.

Formula:

Interest Coverage = Earnings Before Interest and Taxes (EBIT) / Interest Expenses

Liquidity Ratios

11. Current Ratio

Measures a company’s ability to meet short-term obligations.

Formula:

Current Ratio = Current Assets / Current Liabilities

12. Quick Ratio

Measures a company’s ability to meet short-term obligations using its most liquid assets.

Formula:

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Additional Information

Current Liabilities Formula

Current liabilities include obligations due within a year.

Formula:

Current Liabilities = Short-term Debt + Accounts Payable + Accrued Expenses + Taxes Payable + Other Short-term Liabilities

Are Long-Term Loans Included in Current Liabilities?

No, long-term loans are not included in current liabilities. Long-term loans have repayment terms longer than one year and are used for financing long-term investments like real estate, equipment, or major projects. They are considered in solvency ratios rather than liquidity ratios.

Leave a comment